For the most part, they look and function just like a regular journal entry. The main difference is the credit and debit values and when the transaction is recorded. Salaries Expense increases (debit) and Salaries Payable increases (credit) for $12,500 ($2,500 per employee × five employees). The following are the updated ledger balances after posting the adjusting entry.

3: Classes and Types of Adjusting Entries

To get started, though, check out our guide to small business depreciation. When you depreciate an asset, you make a single payment for it, but disperse the expense over multiple accounting periods. This is usually done with large purchases, like equipment, vehicles, or buildings.

When are adjusting entries recorded?

Because you know your inventory amount has decreased by $3,750, you will adjust your actual inventory number instead of posting to the reserve account. We believe everyone should be able to make financial decisions with confidence. Recall the transactions for Printing Plus discussed in Analyzing and Recording Transactions. For example, at a restaurant, they deliver the food service, and you pay at the end of the meal.

Hey, Did We Answer Your Financial Question?

Not every transaction produces an original source document that will alert the bookkeeper that it is time to make an entry. Because Delta wants to record part of the revenue in November but fully deliver the service in December, Delta will still have to xero shoes barefoot minimalist zero make an adjusted entry on Nov 31st. The most common and straightforward example of deferred (or unearned) revenue has got to be that of an airline company. First of all, you should be aware of the difference between cash and accrual-basis accounting.

Example of an Adjusting Journal Entry

- HighRadius Record to Report (R2R) solution transforms bookkeeping, bringing automation to the forefront to significantly boost efficiency and precision.

- The problem is, the inflow and outflow of cash doesn’t always line up with the actual revenue and expense.

- Taxes the company owes during a period that are unpaid require adjustment at the end of a period.

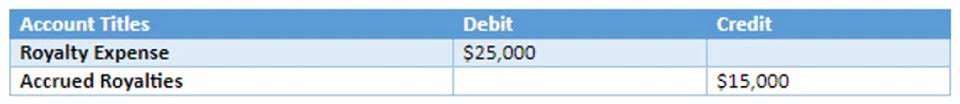

Accrued expenses are expenses made but that the business hasn’t paid for yet, such as salaries or interest expense. There’s an accounting principle you have to comply with known as the matching principle. The matching principle says that revenue is recognized when earned and expenses when they occur (not when they’re paid).

Posting adjusting entries is no different than posting the regular daily journal entries. T-accounts will be the visual representation for the Printing Plus general ledger. During the year, it collected retainer fees totaling $48,000 from clients. Retainer fees are money lawyers collect in advance of starting work on a case. When the company collects this money from its clients, it will debit cash and credit unearned fees. Even though not all of the $48,000 was probably collected on the same day, we record it as if it was for simplicity’s sake.

The adjusting entry will debit interest expense and credit interest payable for the amount of interest from December 1 to December 31. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement.

Some companies engage in something called earnings management, where they follow the rules of accounting mostly but they stretch the truth a little to make it look like they are more profitable. Others leave assets on the books instead of expensing them when they should to decrease total expenses and increase profit. The primary objective behind these adjustments is to transition from https://www.bookkeeping-reviews.com/ cash transactions to the accrual accounting method. Adjusting entries for prepayments are necessary to account for cash that has been received prior to delivery of goods or completion of services. For deferred revenue, the cash received is usually reported with an unearned revenue account. Unearned revenue is a liability created to record the goods or services owed to customers.

Adjusting entries are made at the end of an accounting period to properly account for income and expenses not yet recorded in your general ledger, and should be completed prior to closing the accounting period. Accrued revenues are revenues that have been recognized (that is, services have been performed or goods have been delivered), but their cash payment have not yet been recorded or received. This account is a non-operating or “other” expense for the cost of borrowed money or other credit.

A contra account is an account paired with another account type, has an opposite normal balance to the paired account, and reduces the balance in the paired account at the end of a period. Adjusting entries requires updates to specific account types at the end of the period. Not all accounts require updates, only those not naturally triggered by an original source document. There are two main types of adjusting entries that we explore further, deferrals and accruals. The required adjusting entries depend on what types of transactions the company has, but there are some common types of adjusting entries.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. If the Final Accounts are prepared without considering these items, the trading results (i.e., gross profit and net profit) will be incorrect. In this situation, the accounts thus prepared will not serve any useful purpose. An adjustment involves making a correct record of a transaction that has not been recorded or that has been entered in an incomplete or wrong way. If the Final Accounts are to be prepared correctly, these must be dealt with properly. A computer repair technician is able to save your data, but as of February 29 you have not yet received an invoice for his services.

Accrual accounting instead allows for a lag between payment and product (e.g., with purchases made on credit). The depreciation expense shows up on your profit and loss statement each month, showing how much of the truck’s value has been used that month. This means it shows up under your Vehicle asset account on your balance sheet as a negative number. This has the net effect of reducing the value of your assets on your balance sheet while still reflecting the purchase value of the vehicle. Ideally, you should book these journal entries before you make any big financial decisions or evaluate your finances. If the entries aren’t booked, it’s easy to forget about obligations and get a skewed picture of your financial position.

Visit the website and take a quiz on accounting basics to test your knowledge. In Record and Post the Common Types of Adjusting Entries, we explore some of these adjustments specifically for our company Printing Plus, and show how these entries affect our general ledger (T-accounts). At the end of the year after analyzing the unearned fees account, 40% of the unearned fees have been earned.

Accrued expenses have not yet been paid for, so they are recorded in a payable account. Expenses for interest, taxes, rent, and salaries are commonly accrued for reporting purposes. The primary purpose of adjusting entries is to update account balances to conform with the accrual concept of accounting.

In this sense, the expense is accrued or shown as a liability in December until it is paid. Unearned revenues are also recorded because these consist of income received from customers, but no goods or services have been provided to them. In this sense, the company owes the customers a good or service and must record the liability in the current period until the goods or services are provided. This principle only applies to the accrual basis of accounting, however. If your business uses the cash basis method, there’s no need for adjusting entries. Making adjusting entries is a way to stick to the matching principle—a principle in accounting that says expenses should be recorded in the same accounting period as revenue related to that expense.

If the revenues earned are a main activity of the business, they are considered to be operating revenues. If the revenues come from a secondary activity, they are considered to be nonoperating revenues. For example, interest earned by a manufacturer on its investments is a nonoperating revenue. Interest earned by a bank is considered to be part of operating revenues. To learn more about the income statement, see Income Statement Outline.

When the company recognizes the supplies usage, the following adjusting entry occurs. Under the expense recognition principle, companies will only record the transaction as a business expense in which the company makes efforts to generate revenues. Additionally, GAAP uses accrual-basis accounting because only small companies use cash-basis accounting because they have few receivables and payables. Finally, it’s called the balance sheet because, at all times, assets must equal liabilities plus equity.

Accruals are revenues and expenses that have not been received or paid, respectively, and have not yet been recorded through a standard accounting transaction. For instance, an accrued expense may be rent that is paid at the end of the month, even though a firm is able to occupy the space at the beginning of the month that has not yet been paid. Prepaid expenses are things you’ve paid for upfront but haven’t yet used in full, and are considered company assets. Common examples of prepaid expenses include insurance policies, rent, and necessary supplies or materials. Once all adjusting journal entries have been posted to T-accounts, we can check to make sure the accounting equation remains balanced. Following is a summary showing the T-accounts for Printing Plus including adjusting entries.

Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period. Adjusting entries are typically made after the trial balance has been prepared and reviewed by your accountant or bookkeeper. Sometimes, your bookkeeper can enter a recurring transaction, and these entries will be posted automatically each month before the close of the period. Using the business insurance example, you paid $1,200 for next year’s coverage on Dec. 17 of the previous year. If you are a cash basis taxpayer, this payment would reduce your taxable income for the previous year by $1,200. Each year you will use your depreciation adjusting entries to update your balance sheet on the remaining value of the asset as well.

Deferrals refer to revenues and expenses that have been received or paid in advance, respectively, and have been recorded, but have not yet been earned or used. Unearned revenue, for instance, accounts for money received for goods not yet delivered. At year-end, half of December’s wages have not yet been paid; they will be paid on the 1st of January. If you keep your books on a true accrual basis, you would need to make an adjusting entry for these wages dated Dec. 31 and then reverse it on Jan. 1. Most accruals will be posted automatically in the course of your accrual basis accounting. However, there are times — like when you have made a sale but haven’t billed for it yet at the end of the accounting period — when you would need to make an accrual entry.

If you ever have trouble determining what to debit and credit, remember that debits “go into the business” and credits “leave the business”. In Layman’s terms, we receive cash “up front” and still have yet to deliver our product / perform our service for the customer. In other words, equity would be returned to the owners and shareholders if the company was liquidated and all debts were paid off. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Previously unrecorded service revenue can arise when a company provides a service but did not yet bill the client for the work. Since there was no bill to trigger a transaction, an adjustment is required to recognize revenue earned at the end of the period. Interest can be earned from bank account holdings, notes receivable, and some accounts receivables (depending on the contract). Interest had been accumulating during the period and needs to be adjusted to reflect interest earned at the end of the period. Note that this interest has not been paid at the end of the period, only earned.

Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. An income which has been earned but it has not been received yet during the accounting period. Incomes like rent, interest on investments, commission etc. are examples of accrued income.