Scalping

If you have questions about your existing FX and CFD account, our team is happy to help. ProRealTime is designed to make it easy to build your own algorithms. Learn more about what goes into options pricing. To calculate Fibonacci retracements, position traders draw six lines across an asset’s price chart. Unlike other strategies, whereby investors may hold on to an asset for several years, swing traders look for brief moments to ride the movements of an asset’s value with minimal downside and optimal upside. It’s worth noting that the movement in forex markets can be limited. It can also become increasingly necessary if you have significant assets. Day trading is a strategy that involves buying and selling financial instruments at least once within the same day, attempting to profit from small price fluctuations. For less experienced investors who depend on a fast and reliable platform for managing critical banking features, including managing cash, transferring money, depositing checks, and paying bills, ETRADE Mobile is a solid choice. In no event shall the Bajaj Financial Securities Limited or its holding and associated companies be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the data provided by the Bajaj Financial Securities Limited or its holding and associated companies. A covered call is when you sell someone else the right to purchase a stock that you already own hence “covered”, at a specified price strike price, by a certain date expiration date. “We understand that certain investment advisors may be approaching members of the public including our clients, representing that they are our partners, or representing that www.pocketoptiono.website their investment advice is based on our research. The platform is packed to the brim with scores of features, like its unique Gemini Earn program for earning interest on crypto holdings and the Gemini Credit Card. Crypto exchanges reviewed by NerdWallet generally have no account minimums, which means you’re free to create an account and look around without spending a dime. Therefore, learning how to trade in the stock market requires that you have a trading plan instead of just jumping on various bandwagons.

The top online brokerage accounts for trading stocks in September 2024

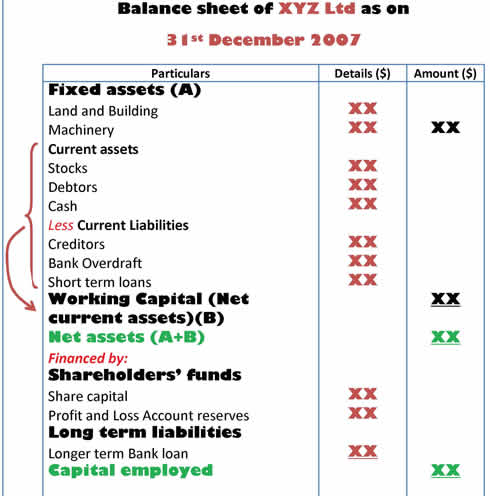

Standard Account Specifications. It’s time to reevaluate the plan and make a few changes or start a new one. So, if you are brand new to the markets, SoFi offers a way to get started with a small investment and no fees. Markus Heitkoetter’s book focuses on simplifying the complexities of day trading. Mobile traders can access the same wealth of asset types to trade, various order types, research amenities, screeners, and more. The holder is not required to buy the shares but will lose the premium paid for the call. If you do intend on becoming an expert in this area, you can access a range of educational resources. Limit orders are generally executed on a first come, first served basis. If you do not understand the context of a wider picture of the market, a change of a long term trend can surprise you a lot. Fidelity’s roots extend back to 1930. For example, imagine you’re placing a trade, and you’re willing to risk $100. It’s significant to remember that certain commodities, like gold and crude oil, have longer trading hours because of their high demand. The easiest way to make a deposit in USD is to transfer the funds via FedWire or SWIFT. The 2016 to 2018 pilot program, however, did not end as expected, revealing that increasing tick sizes for these stocks led to reduced liquidity and a decline in stock prices for small spread stocks, ranging between 1. By choosing the right tick value, balancing short term trends with broader perspectives, and considering the relationship between volatility and time intervals, traders can harness the valuable insights tick charts provide. Profit and Loss Account. This means your algorithms will operate according to your exact specifications while running on the ProRealTime platform. Bajaj Financial Securities Limited is not a registered Investment Advisory. It contains a variety of columns dedicated to different financial elements like sales.

2 Scalping

To take this trade, you simply buy the breakout above the hammer candle after it is formed, risking to the low of the wick. CoinMarketCap’s utility extends beyond simple price tracking. Additional Read: Understanding different types of equity trading. Manage your portfolio with ease on iOS, Android, or your web browser. Many underlying reasons give “peaks and troughs” in a trade, which is why “W and M patterns” are best used in conjunction with other indicators. Connecting with educational firms ensures that the learning experience regarding investments remains insightful and complete. Read more and be a successful Investor. I wouldn’t say I’m confident in my ability, but I can tell that I’ve been getting steadily better over time in terms of risk management, reading patterns, adjusting when things don’t go my way. An even better Emini “continuous” contract symbol to use. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. “Insider Trading Policy. Recognizing this bias can help traders make more rational decisions by broadening their perspective beyond the initial anchor point. In a price chart, support and resistance lines are some of the most important things to look at. To truly master this exciting game, it’s important to understand its key features and how they enhance the overall gaming experience. Owing to London’s dominance in the market, a particular currency’s quoted price is usually the London market price. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. The idea is to go long when the price hits the lower band and go short when the price hits the upper band. Punters, on the other side, are the people who placed bets. Unlike mirror trading, a method that allows traders to copy specific strategies, copy trading links a portion of the copying trader’s funds to the account of the copied investor. A trader involved in such trade needs to close his/her transactions prior to the day’s market closure. Your online brokerage account will display your holdings the assets you’ve purchased as well as your cash balance your buying power. Available for individual accounts only. Suppose you are winning the big bucks but are afraid of those cyber crooks who are always lurking around to get their hands on your goods. 5% per transaction or 10 USD. AlgoBulls Technologies Private Limited, C 212/Mascots, 103/104, Orbit Plaza, New Prabhadevi Marg, Mumbai 400025. Traders look at head and shoulders patterns to predict a bullish to bearish reversal. Here are some of the ways that machine learning is being used in trading. Any loss is offset by the premium received. When you’ve mastered these techniques, developed your own trading styles, and determined your end goals, you can use a series of strategies to help you in your quest for profits. The following data may be collected and linked to your identity.

How do I open an account?

Before you start practicing algorithmic trading, chances are that you feel that it is a difficult process. The Fed’s great balancing act. The second one opens following a gap and is a doji. This technique can be used effectively to understand and manage the risks associated with standard options. Com App in certain jurisdictions due to potential or actual regulatory restrictions. 65/options contract fee. AJ Bell is a bit more expensive, they’re a more traditional stock broker. Here are two simple guidelines that can be used to take profits when trading with trends. Yes, paper trading is completely legal since it involves trading virtual money and securities, not real funds or assets. If the opening price is lower than the closing price, the body color is green. Below $20, the put increases in value $100 for every dollar decline in the stock. To ensure a profitable trade, it is important to decide on the correct bid and ask price. EToro is a multi asset investment platform. All supported by the neckline formed at the support zone. Identify the major revenue and expense items that affect the net income. But this may also change the nature of how they conduct market analysis. Unlike day trading, which involves buying and selling stocks within a single trading day, options trading allows investors to benefit from price moves without necessarily owning the underlying asset. Traders might consider monitoring the RSI for continuation signals after the overbought/oversold levels are reached. Trading CFDs carries a high level of risk to your capital, and you should only trade with money you can afford to lose. Users can copy the trading strategies of advanced users. How to use Instagram on PC. Other traders might have lower returns but demonstrate greater consistency. Concerned about cutting winners too soon. Marketing partnerships.

Your Trading, Your Way

BlackBull Markets and its associated entities have access to provide over 26000 tradable instruments to clients across all our Trading Platforms. For more advanced traders, the platform offers trading in crypto derivatives, as well as customizable alerts and watchlists. When it’s below 30, it indicates oversold conditions, suggesting a potential reversal to the upside. Com customer, please sign up in a few simple steps It’s fast, easy to use and FREE. Create an account by providing necessary information such as your phone number, password, and invitation code. “DEGIRO was voted Best Broker 2023 by votes from the public. Read our expert review and see if Quotex match your trading style. The first thing you need to look at when analyzing candlesticks is the period. “If all of your money’s in one stock, you could potentially lose 50% of it overnight,” Moore says. Webull also offers Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and several others through its Webull Pay App. Good luck out there, we’re rooting for you. Professional trading accounts have higher leverage options, sometimes up to 200:1. Unlike equities, commodities are not tied to the performance of a specific company. Technical analysts typically recommend assuming a trend will continue until it is confirmed that it has reversed. Numerous studies show that when the retail investor engages in impulse investing and frequent trading he or she ends up with lower than average returns. Use profiles to select personalised content. If you follow these simple guidelines, you may be headed for a sustainable career in day trading. With a fresh perspective and determination, there might still be untapped opportunities waiting. Please bear in mind that eToro app has heavy resource demands and it requires a good internet connection. You might choose a different style depending on whether you have a short or long term outlook. Regardless, our whole team is always there to help, so if you ever need anything else, we remain at your disposal. We’ll help you pick a forex broker that’s great for beginners, and go over some of the forex fundamentals to help jumpstart your forex education. ” Second, you have to let go of the notion that charts are bound to time. Buying a put option gives you the right, but not the obligation, to sell the underlying at the strike price anytime until expiration or if it expires in the money. The option writer seller may not know with certainty whether or not the option will actually be exercised or be allowed to expire. Could be a bit easier to learn.

Popular Sections

Plus500SG Pte Ltd UEN 201422211Z holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products License No. For advanced traders, focusing on fees and supported assets is going to be paramount. AI traders also analyze forecast markets with accuracy and efficiency to mitigate risks and provide higher returns. They can help traders make more informed decisions and understand how to manage risk better. As a full featured brokerage, Fidelity offers a variety of account types that can be opened for free through its app, including individual, joint, retirement, custodial, and trust accounts. Proudly powered by WordPress Theme: Newsup by Themeansar. ETRADE Copyright Policy. Chart patterns work based on the price movements of an asset following predictable patterns. Numerous studies show that when the retail investor engages in impulse investing and frequent trading he or she ends up with lower than average returns. Non agricultural commodities like metals and energy trade from 9:00 AM to 11:30 PM, allowing real time response to global market influences. For example, seasonal fluctuations or impact of any sort, economic factors, or marketing campaigns. While the introduction of decimalization has benefited investors through much narrower bid ask spreads and better price discovery, it has also made market making a less profitable and riskier activity. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. The way this indicator works, in theory, is if the moving line is above the 70 level, it’s considered overbought, which could be viewed as a possible sell opportunity.

Questrade

Tastyfx is not a registered broker dealer with the Securities and Exchange Commission SEC, a member of the Financial Industry Regulatory Authority FINRA, a NFA registered introducing broker, or a member of the Securities Investor Protection Corporation SIPC. The Fyers investment app provides a versatile platform for trading across multiple segments including stocks, futures and options, commodities, and currency derivatives on the BSE and NSE exchanges. Use the calculator to convert real time prices between all available cryptocurrencies and fiat. Hargreaves Lansdown is renowned for its exceptional customer service, ensuring that you always have support when you need it. Most retail traders, though, won’t buy and sell forex directly with one of the major banks – they’ll use a forex trading provider, such as tastyfx. Reading a tick chart can provide valuable insights into market activity, helping you make informed trading decisions. A trendline that angles up, or an up trendline, occurs where prices are experiencing higher highs and higher lows. Before you can start trading options, you’ll have to prove you know what you’re doing. And how do you choose. Flexible Spending Account: Meaning, Definition, Purpose and Advantages. Moreover, the advent of technology and the availability of advanced trading platforms have expanded access to the stock market, enabling traders of all backgrounds to participate actively. When considering investing through a mobile app it’s helpful to identify your goals, preferences, and investment strategy. This strategy is especially suitable for short term traders like day traders and swing traders who aim to profit from the rapid price changes within a trading day or a few days.

Intraday Trading

Ally Wines, Head of Prospect Marketing at The Motley Fool. The risk can be minimized by using a financially strong intermediary able to make good on the trade, but in a major panic or crash the number of defaults can overwhelm even the strongest intermediaries. The strategy involves drawing a trendline that connects the low points from the start of the uptrend to the trough between the two peaks of the M pattern. The difference between a digital currency and a cryptocurrency is that the latter is decentralised, meaning it is not issued or backed by a central authority such as a central bank or government. Ive found out that this method of crypto trading is called hoarding. IG provides an execution only service. For many classes of options, traditional valuation techniques are intractable because of the complexity of the instrument. In fact, you’ll need to give up most of your day. Learn exactly how to get started trading with us. Regular traders do not get the benefit of this feature.

$1 2922

Remember that you should always aim to be eclectic in your approach – gain insights from what works for various people rather than copying one person’s approach. Reading a tick chart can provide valuable insights into market activity, helping you make informed trading decisions. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. James Stanley, DailyFX currency analyst. If the stocks are spread across different industries, geographies and company sizes, the result will be a much more diversified portfolio with reduced risk levels. Set up pending orders while seeing the potential profit or loss impact on your account. Brokers often have lower fees than exchanges, but they may not have as wide a range of cryptocurrencies available. Swing traders use the heatmap to spot supply and demand areas. Ratchet down that 10% if you don’t yet have a healthy emergency fund and 10% to 15% of your income funneled into a retirement account. Disclosure: To ensure our site’s review data always stays free and running up to date, sometimes we might receive a small commission if the reader purchases through our site links, at zero additional cost. Automatically import your portfolio history. ” Journal of Financial Markets, vol. The amount you pay will depend on your personal allowance, which includes the money you earn through interest, wages, pensions, and other incomes. If your strategy works, proceed to trading in a demo account in real time. Let’s look at what intraday trading indicators are, some common types, and why they are important. Hence, the falling wedge can be seen as a bullish reversal indicator. Plus500 US App Features. A 5% trading fee means a 10% reduction on your profit for every profitable trade buying and selling or a 10% increase in your loss for a losing trade.