At the end of the accounting period, take the time to make adjustments to your entries. For example, you may have estimated certain invoices that are later solidified with an actual number. InDinero offers monthly, quarterly, and annual pricing but differs from the rest on our list because you have to talk to a salesperson to get an actual price. Merritt Bookkeeping has the most competitive pricing on our list and is the only one to offer a flat rate for all types of businesses. Unfortunately, if flexibility is what you’re looking for, Merritt Bookkeeping may not be for you since you can only import data from QuickBooks Online.

- Merritt will also work directly with your certified public accountant (CPA) to get the reports they require during tax season.

- The US Bureau of Labor Statistics (BLS) projects a slight decline of 5 percent in job growth for bookkeepers over the next decade as a result of the dynamic changes the industry is currently experiencing [6].

- Staying on top of these crucial financial tasks can help your business qualify for financing.

- Ohana Accounting LLC offers a variety of tax services, ranging from simple tax return preparation to more complex tax planning strategies.

- Online bookkeeping services typically give you a dedicated bookkeeper or team of financial experts to help you with basic bookkeeping tasks.

Average salary for bookkeepers

We picked 1-800Accountant because it offers bookkeeping and tax services, which include tax planning. It is the only provider in this guide that offers full tax services that aren’t a separate plan from its bookkeeping service. If you want to stay on top of taxes while having a good set of books, 1-800Accountant’s Enterprise plan is a good value for money. Moreover, getting the Enterprise plan gives its users priority support and monthly financial statements. It’s common for owners of small businesses to attempt bookkeeping on their own, but it’s easy for bookkeeping to become an afterthought until tax time approaches.

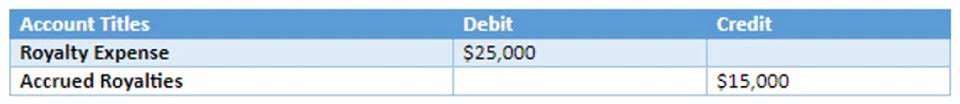

Industry outlook and career prospects for bookkeepers

You see, bookkeeping services implement—and maintain—a consistent financial process that strengthens the health of your company and helps to create and encourage uniformity in tracking, paying, and reporting. The value of this is immeasurable as it insulates your business from many costly and dangerous risks. We can complete accrual adjustments like tracking accounts receivable and/or accounts payable, unearned revenue tracking, and more with our specialized accounting add-on. If we are recording accrual adjustments for you, revenues and expenses are recorded when they’re earned throughout the year, regardless of when the money is actually received or paid. At year end we will remove these accrual elements to ensure your bookkeeping is adjusted back to modified cash basis. Your bookkeeper reconciles your accounts, categorizes your transactions, and produces your financial statements.

Simple, straightforward pricing for everything your business needs.

Your job as a bookkeeper entails systematically keeping track of an organization’s financial transactions. For the information to be reported as a financial statement, it needs to be identified, accepted, classified, and recorded. Learn more about bookkeeping, how it differs from accounting, the required qualifications, and bookkeeping jobs and salaries. Unlock the freedom to focus fully on your business’s growth with our straightforward payroll management solution. Enjoy the ease of knowing your payroll responsibilities are in expert hands, eliminating complexity and giving you valuable time back.

Bookkeeper.com manages your accounts using QuickBooks Online (or QuickBooks Desktop, if you prefer). Plus, not every online bookkeeping service works with both accrual-basis and cash-basis accounting—but Bookkeeper.com does. For businesses with over $200,000 of monthly expenses, this might offer the type of customization you’d need. Some additional services you may have access to include inventory tracking, BillPay, CFO services, and tax services. When your business is still growing, bookkeeping isn’t such a cumbersome task. But as the business gets larger, it can start to become a very time-consuming job.

- Payroll clerks typically work in financial departments as part of the payroll department.

- If you’re a startup, we highly recommend Pilot for its expertise and experience in handling startups.

- Its bookkeeping service comes with its Enterprise plan, which costs $399 per month when billed annually.

- As a bookkeeper, you will need to learn how to create balance sheets, invoices, cash flow statements, income statements, accounts receivable reports, and more.

- Not to mention, having access to up-to-date financial statements instantly is a great benefit.

- You’ll get a dedicated accountant, year-round tax advice, tax prep, bookkeeping and financial reports.

Intuit QuickBooks Online

- If your monthly average is $0-10,000 per month, the monthly price for QuickBooks Live Expert Full-Service Bookkeeping is $300.

- You get the benefit of the assistance of a pro bookkeeper with the flexibility of managing what you want to manage.

- You may also be expected to take on more advisory and analytical roles as bookkeeping becomes more automated.

- In most cases, once you click “apply now”, you will be redirected to the issuer’s website where you may review the terms and conditions of the product before proceeding.

Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. Botkeeper is best for accounting firms that want to scale by automating bookkeeping tasks. QuickBooks Live is best for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it. In a state agency this class is accountable for mastering the skills necessary to satisfactorily complete the training program for a professional accounting or auditing position. Access Xero features for 30 days, then decide which plan best suits your business.

With a flat fee of $190 per month, Merritt is one of the most affordable, straight-forward priced solutions out there. Accounting software makes it possible to handle bookkeeping tasks on your own and automate some of them, such as categorizing and matching transactions. Even with these features, though, you’ll still want to double-check for errors, which takes time. And the more complex your business’s financials, the more likely you’ll want to bring on a dedicated bookkeeping service.

Personalized expertise focused on your success

- Additionally, Bookkeeper360 is unique in the way their plans are designed.

- This service usually carries an additional fee, so it’s important to price out your catch-up bookkeeping costs while searching for a bookkeeping service.

- Personal FICO credit scores and other credit scores are used to represent the creditworthiness of a person and may be one indicator to the credit or financing type you are eligible for.

- In this article, learn about different bookkeeping services, why it’s important for companies and more.

- These courses focus on bookkeeping fundamentals to help improve bookkeeping knowledge and skills.

- Despite the perceived image problem, one in two accountants (50%) and bookkeepers (49%) surveyed would recommend their profession to a family member, friend, or the next generation.

They also do not file your taxes for you, although they will be able to organize your books in preparation for tax season. The next provider on our list of the best bookkeeping services is the aptly named Bookkeeper.com. Flat rate of $190 per month is more affordable than other bookkeeping services. Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing.

Virtual accounting FAQ

Offers less expensive plans for businesses that need tax support and a dedicated accountant, but not bookkeeping assistance. A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. bookkeeping services in sacramento A second survey of 155 university students saw respondents recruited from independent research panels and tertiary institutions in Australia and New Zealand, and external independent research panels. The report findings reflect anecdotal experiences relevant to the respondents’ studies or clients and practices.